-

Welcome! Bienvenidos! английский Willkommen! Benvenuti! الإنجليزية Welkom! ਅੰਗਰੇਜ਼ੀ Boas-Vindas! Hoşgeldiniz! Wellkom! 英语

The Black Scholes equation is a partial differential equation, which describes the price of the derivative (option or warrant) over time. In the financial world, a derivative is a financial instrument, whose value depends on the value of other, more basic, underlying variables. Very often the variables underlying derivatives are the prices of traded assets. A stock option, for example, is a derivative whose value is dependent on the price of a stock.

The extended Black Scholes models are jump-diffusion models, stochastic volatility models, local volatility models, regime-switching models, garch models. The Greeks are the sensitivities of the option prices to the various parameters.

If you need expertise on implementing Financial Algorithms or High Frequency Trading Algorithms on Hardware(RTL) in most efficient way, please contact me. The Black Scholes RTL IP Core can be downloaded here. I used this tool to verify the Hardware implementation of the financial functions. I hope it helps you too. Enjoy!| Price |

| First-Order Greeks |

|

Delta (Δ)

Delta (Δ)

The delta of an option or a portfolio of options is the sensitivity of the option or portfolio to the change in the price of the underlying security. It is the rate of change of value with respect to the asset The delta of a portfolio of options is just the sum of the deltas of all the individual positions. Delta hedging means holding one of the option and short a quantity ∆ of the underlying. Delta can be expressed as a function of S and t. This function varies as S and t vary. This means that the number of assets held must be continuously changed to maintain a delta neutral position, this procedure is called dynamic hedging. Changing the number of assets held requires the continual purchase and/or sale of the stock. This is called rehedging or rebalancing the portfolio. |

|

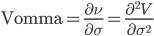

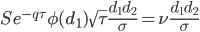

Vega (ν)

Vega (ν)

Vega measures the calculated option value's sensitivity to small changes in volatility. As with gamma hedging, one can vega hedge to reduce sensitivity to the volatility. This is a major step towards eliminating some model risk, since it reduces dependence on a quantity that is not known very accurately. |

|

Theta (Θ)

Theta (Θ)

Theta measures the calcualted option value's sensitivity to changes in time till maturity. The Theta is related to the option value, the delta and the gamma by the Black-Scholes equation. In a delta-hedged portfolio the theta contributes to ensuring that the portfolio earns the risk-free rate. |

|

Rho (ρ)

Rho (ρ)

Rho, ρ is the sensitivity of the option value to the interest rate

used in Black-Scholes

|

|

Lambda (λ)

Lambda (λ)

Lambda (elasticity) is the percentage change in option value per percentage change in the underlying security price, a measure of leverage, sometimes called gearing. |

| Second-Order Greeks |

|

Gamma (Γ)

Gamma (Γ)

Gamma is the sensitivity of the delta to the underlying it is a measure of by how much or how often a position must be rehedged in order to maintain a delta-neutral position. Since gamma is a measure of sensitivity of the hedge ratio ∆ to the movement in the underlying, the hedging requirement can be decreased by a gamma-neutral strategy. This means buying or selling more options, not just the underlying. Because the gamma of the underlying (its second derivative) is zero, gamma cannot be added to position just with the underlying. We can have as many options in our position as we want, we choose the quantities of each such that both delta and gamma are zero. |

| Vanna |

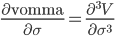

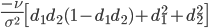

| Vomma |

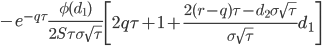

| Charm |

| Veta |

| Vera |

| Third-Order Greeks |

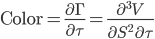

| Color |

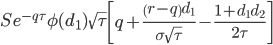

| Speed |

| Ultima |

| Zomma |

| Dual Delta |

| Dual Gamma |

| Call Price |

Put Price |

| Call Delta | Put Delta |

| Vega | |

| Call Theta | Put Theta |

| Call Rho | Put Rho |

| Lambda | |

| Gamma | |

| Vanna | |

| Vomma | |

| Call Charm | Call Charm |

| Veta | |

| Vera | |

| Coloro | |

| Speedo | |

| Ultima | |

| Zomma | |

| Call Double Delta | Put Double Delta |

| Double Gamma |

| φ | The standard normal probability density function. | ||

| Φ | The standard normal cumulative distribution function. | ||

| S | Security Price | ||

| X | Strike Price | ||

| r | Risk-Free Rate | ||

| q | Annual Dividend Yield | ||

| τ | Time to Maturity τ = T-t | ||

| σ | Volatility | ||

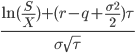

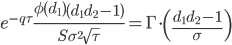

| d1 |

|

||

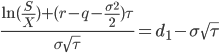

| d2 |

|

||

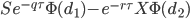

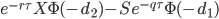

| Calls | Puts | ||

| Option Value (V) |  |

|

|

| Delta |

|

|

|

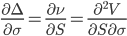

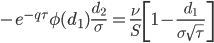

| Vega |

|

|

|

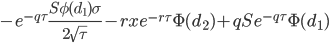

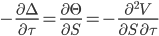

| Theta |  |

|

|

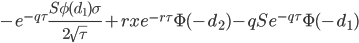

| Rho |  |

|

|

| Lambda | Delta* (S/V) |  * (S/V) * (S/V) |

* (S/V) * (S/V) |

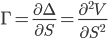

| Gamma |  |

|

|

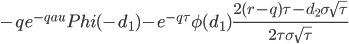

| Vanna |

|

|

|

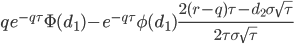

| Charm |

|

|

|

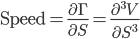

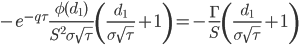

| Speed |

|

|

|

| Zomma |

|

|

|

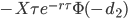

| color |

|

|

|

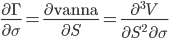

| Veta |

|

|

|

| Vomma |

|

|

|

| Ultima |

|

|

|

| Totto | dVomma/dT | ||

| Dual Delta |  |

|

|

| Dual Gamma |  |

||